is the interest i paid on my car loan tax deductible

Reporting the interest from these loans as a tax deduction is fairly straightforward. In this case neither the business portion nor the personal portion of the interest will be deductible.

Lenders Now Must Report More Information About Your Mortgage To The Irs The Washington Post

Be sure to keep copies of your loan documents and records of your interest.

. Typically deducting car loan interest is not allowed. Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest.

If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized. Up until 1986 it was possible for auto loan interest to be tax deductible. You cannot deduct the actual car operating costs if you choose the standard mileage rate.

But there is one exception to this rule. The personal portion of the interest will not be deductible. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

Unfortunately car loan interest isnt deductible for all taxpayers. The interest paid on a HELOC is tax deductible as long as you use the funds to purchase repair or make substantial improvements to the property that secures the loan. However for commercial car vehicle and.

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. You can write off up to 100. Should you use your car for work and youre an employee you cant write off any of the interest you pay on.

In order for interest on a hard money loan to be deductible the loan would have to be used for business purposes. This is because the interest on a business loan is considered a. Tax benefits on Car Loans.

If youre audited by the IRS youll need to be able to show proof of the loan and the interest payments. Experts agree that auto loan interest charges arent inherently deductible. May 10 2018.

If youre claiming 50 percent business use for taxes your deduction. Credit card and installment interest incurred for personal expenses. Loans Must Be Used for Business Purposes.

The standard mileage rate already. If you use your car for business purposes you may be allowed to partially deduct car loan interest as. Thus you are not eligible for any.

For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns. History of the 60L Power Stroke Diesel Engine. Interest paid on a loan to purchase a car for personal use.

Is interest on your car loan tax deductible. Interest on personal loans. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation.

However if you are taking out a loan to purchase a car for business use then the interest may be tax deductible. Points if youre a seller service charges. Car loan interest is tax deductible if its a business vehicle.

The interest you pay on student loans and mortgage loans is tax-deductible. This means that if you pay 1000. This is why you need to list your vehicle as a business expense if you wish to deduct the interest.

Is The Interest You Paid On A Personal Loan Tax Deductible

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Is Personal Loan Interest Tax Deductible Experian

Everything You Need To Know About Claiming A Mileage Tax Deduction

:max_bytes(150000):strip_icc()/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

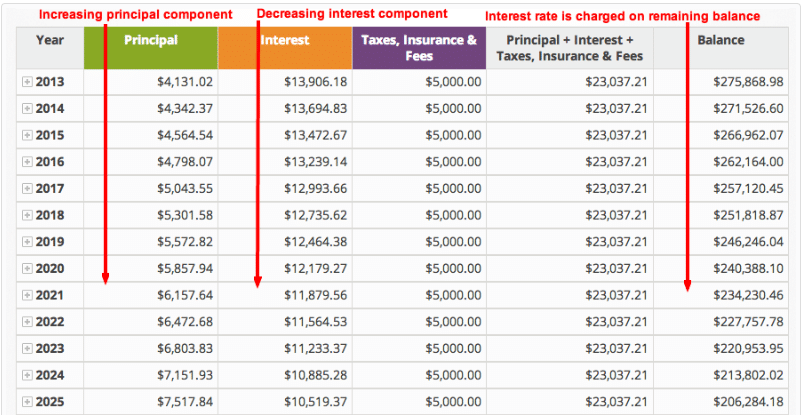

How To Calculate Amortization Expense For Tax Deductions

Is Buying A Car Tax Deductible In 2022

Apr Vs Interest Rate What Does This Mean For Your Car Loan State Farm

Can A Personal Auto Loan Be Tax Deductible

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

Student Loan Interest Deduction 2022 Smartasset

Can The Student Loan Interest Deduction Help You Citizens

How To Calculate Auto Loan Payments With Pictures Wikihow

How Do Personal Loans Affect My Taxes

Updated Can I Deduct My Business Related Auto Expenses On My S Corp Taxes

:max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)